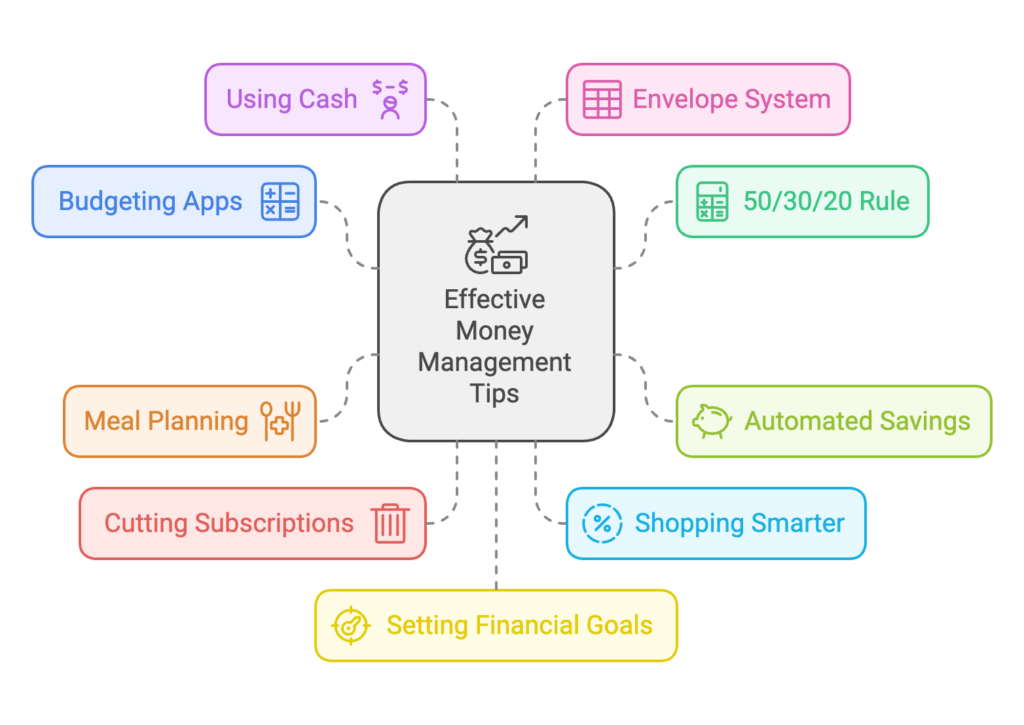

Creating a budget doesn’t have to feel like a chore. In fact, with a few clever tips and tricks, you can turn budgeting into a simple and even enjoyable process. Whether you’re saving for a big purchase, trying to pay off debt, or just looking to have more control over your money, these 10 budget hacks will help you get there faster—and you’ll wish you had learned them sooner!

1. Track Every Dollar with a Budgeting App

It’s easy to lose track of where your money goes. Using budgeting apps like Mint, YNAB (You Need a Budget), or EveryDollar can help you monitor your spending effortlessly. These tools categorize your expenses and give you real-time insights into your finances, so you’ll never wonder where your paycheck disappeared again.

2. Embrace the 50/30/20 Rule

The 50/30/20 rule is a simple budgeting framework: allocate 50% of your income to needs, 30% to wants, and 20% to savings or paying off debt. This hack takes the guesswork out of budgeting and ensures you’re covering all the essentials while still enjoying life.

3. Automate Your Savings

Set up an automatic transfer to your savings account every time you get paid. Start with just $10 or $20 if money is tight, and increase it as your income grows. Automated savings ensure you’re consistently building your financial safety net without having to think about it.

4. Meal Plan to Save on Groceries

Planning your meals for the week not only reduces food waste but also slashes your grocery bill. Write a list before heading to the store, stick to it, and avoid impulse buys. Bonus tip: Shop on a full stomach to resist unnecessary purchases. View our Daily Deals and Discounts!

5. Cut Unused Subscriptions

Take a close look at your monthly subscriptions—streaming services, gym memberships, or app fees you rarely use—and cancel the ones that don’t bring value. You might be surprised how much you’re spending on things you don’t need.

6. Shop Smarter with Cashback and Discounts

Before buying anything, check for cashback offers or coupon codes using tools like Rakuten, Honey, or Ibotta. These apps help you earn money back on purchases or find hidden discounts, making every dollar stretch further. View our Daily Deals and Discounts!

7. Switch to Cash for Variable Expenses

Using cash instead of cards for discretionary spending like dining out or entertainment can help you stick to your budget. Once the cash is gone, you know you’ve hit your limit for the week.

8. Try the Envelope System

Take the cash system one step further with the envelope method. Label envelopes for categories like groceries, gas, and dining, and put your allotted cash inside. This hack keeps you mindful of your spending and ensures you don’t go over budget.

9. Set Financial Goals and Celebrate Milestones

Whether it’s paying off $1,000 in debt or saving for a dream vacation, setting specific goals gives your budget a purpose. Reward yourself when you hit milestones—just make sure the reward doesn’t blow your budget!

10. Review and Adjust Monthly

A budget isn’t set in stone. Take time at the end of each month to review your spending, identify areas where you can cut back, and adjust your budget for the next month. This keeps your finances aligned with your goals.

Final Thoughts

Budgeting doesn’t have to feel restrictive—it’s about making the most of your money and aligning it with your priorities. By implementing these 10 simple hacks, you’ll take control of your finances, reduce stress, and start achieving your financial goals. The best part? You can start today!